In the world of employment and payroll, a pay stub is a crucial document that provides employees with a comprehensive breakdown of their earnings and deductions. Also known as a pay slip, paycheck stub, or salary statement, a pay stub plays a significant role in ensuring transparency and accountability in the payment process. This article will delve into the details of what a pay stub is, its importance, and the essential components it typically includes.

Introduction to Pay Stubs

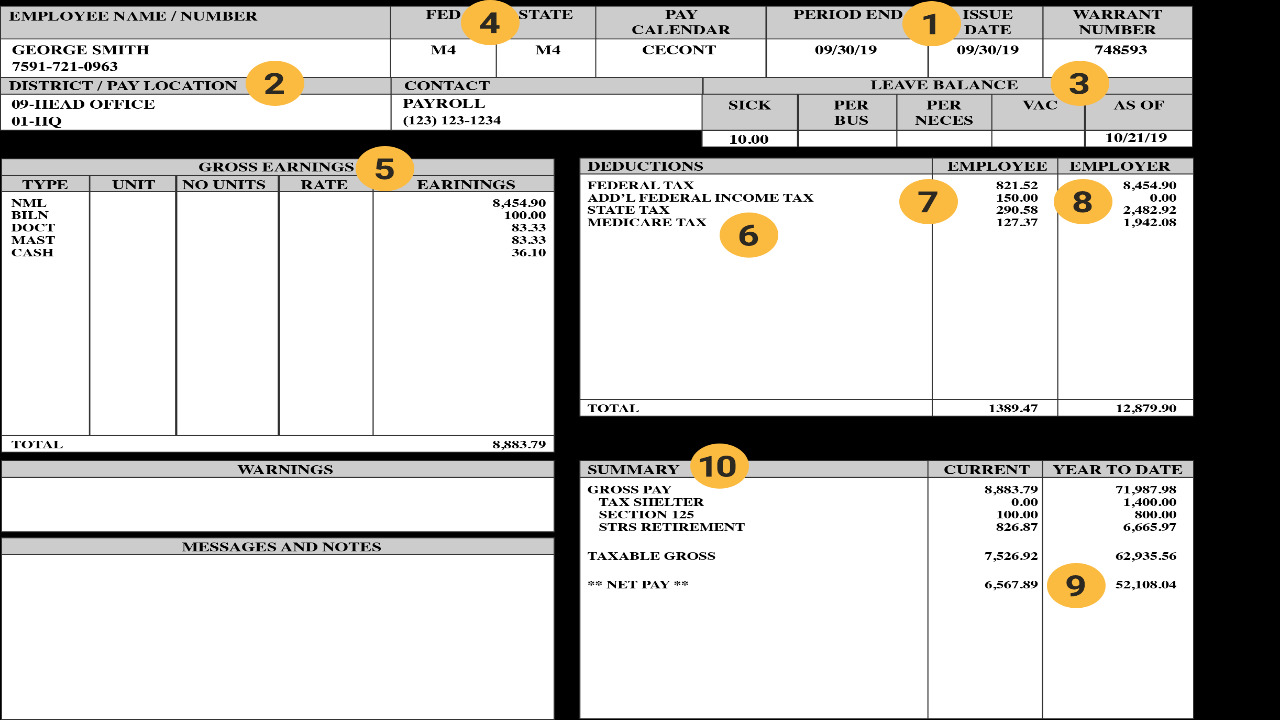

A pay stub is a document issued by an employer to an employee each time they receive their wages or salary. It serves as a detailed record of the employee’s earnings and deductions for a specific pay period. Pay stubs are typically provided alongside the actual payment and can be in the form of a physical document or an electronic file. You can also find pay stub templates from PayStubCreator and use them easily.

Why Are Pay Stubs Important?

Pay stubs hold great importance for both employees and employers. For employees, pay stubs serve as proof of income and provide valuable information regarding their compensation. They can refer to their pay stubs to verify the accuracy of their wages, understand how their earnings are calculated, and ensure that proper deductions have been made.

Employers benefit from pay stubs by maintaining accurate records of employee payments and deductions. Pay stubs also aid in resolving any disputes related to compensation or taxation, as they provide a transparent breakdown of the employee’s earnings.

Components of a Pay Stub

A typical pay stub contains several important components that help employees understand their earnings. These components may vary depending on local regulations and company policies, but here are some common elements:

Employee Information: This section includes the employee’s name, address, and identification number. It ensures that the pay stub is associated with the correct individual.

Earnings: The earnings section outlines the employee’s gross wages for the specific pay period. It typically includes information about regular hours worked, overtime, bonuses, and commissions.

Taxes: This section provides details about the taxes withheld from the employee’s earnings. It includes federal, state, and local income taxes, as well as Social Security and Medicare contributions.

Deductions: Deductions refer to any amounts subtracted from the employee’s gross wages. These can include health insurance premiums, retirement contributions, union dues, and any other authorized deductions.

Net Pay: The net pay section displays the employee’s take-home pay after all deductions and taxes have been subtracted from their gross wages. This is the amount the employee receives in their bank account or as a physical paycheck.

Year-to-Date (YTD) Information: Pay stubs often include a summary of the employee’s earnings and deductions for the year-to-date. This information allows employees to track their overall income and deductions over time.

Accessing Pay Stubs

With the advent of digital technology, many employers now provide electronic pay stubs accessible through online portals or direct email. This allows employees to access their pay stubs conveniently and securely from anywhere. Some companies also offer mobile applications that enable employees to view and download their pay stubs on their smartphones.

In conclusion, a pay stub is a vital document that provides employees with a detailed breakdown of their earnings and deductions. It serves as proof of income and facilitates transparency in the payment process. By understanding the components of a pay stub, employees can gain insights into their compensation, while employers can maintain accurate records of employee payments. Pay stubs play a crucial role in fostering trust and ensuring fairness in the employer-employee relationship.